We answer frequently asked questions or FAQ about buying Houston real estate and real estate in the surrounding communities of Greater Houston including Cypress and Katy.

An REO, is a real estate listing of a home or other real estate owned by a bank or other mortgage lender. It stands for Real Estate Owned by the bank.

An earnest money contract is the most common form of real estate purchase contract in Texas. When using an earnest money contract, a buyer agrees to deposit a small percentage of the sales price with a title company to be held until closing as a sign of their good faith intentions to purchase a home or other real estate. The amount of the earnest money deposit is negotiable between the buyer and seller.

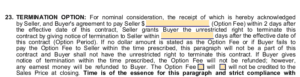

A termination option is a clause in the standard Texas real estate earnest money contract that gives a buyer the unconditional right to terminate the contract during the option period. The buyer must pay a fee to the seller for the right to have the termination option. The length of the option period and the option fee are negotiable between the buyer and the seller. Earnest money contracts are also called option contracts for this reason. In Texas, a typical option period is around 10 days and the typical option fee is about $10.00 to $30.00 per day. However, option fees and option periods are completely negotiable between the buyer and seller.

A title company is a type of trust company that is licensed by the State of Texas to act as an escrow office in a real estate transaction. The title company holds the buyer’s earnest money in a trust or escrow account, researches the title history of the property and issues a title insurance policy insuring the that buyer is receiving a good and valid title to the real estate being purchased and processes the deed and other documents needed to transfer title. The title company disburses the buyer’s and mortgage lenders funds to the seller at the closing and pays off all existing mortgages and liens on the property.

A short sale is a situation where a homeowner is attempting to sell a home that is worth less than the amount owed on its existing mortgage with their mortgage lender accepting the loss. The homeowner’s mortgage holder must approve the sale. It can take an additional 30 to 90 days to obtain the lender approval for a short sale offer.

An option contract is a form of earnest money contract in Texas that gives the buyer the unrestricted right to terminate the contract during a set period of time after signing the real estate contract. The buyer must pay a fee to the seller for the right to terminate the contract. A real estate buyer will normally have their inspections performed during the option period. The buyer will then have the opportunity to negotiate with the seller for any repairs that are needed during the option period.

The option fee and option period are negotiated between the buyer and seller. A typical option period is 10 days. The typical option fee can range from $100 to $300. If the buyer fails to deliver the option fee to the seller or listing agent within 48 hours of the contract execution date, they will lose the right to terminate the contract under the option clause.

A Texas real estate agent is a person licensed by the state of Texas to practice real estate. A Texas real estate agent may assist clients in buying and selling real estate and in the management and rental of properties. A real estate agent must work under the supervision of a Texas real estate broker. Texas officially calls a real estate agent, a real estate salesperson.

A Texas real estate broker is an experienced real estate agent with a minimum of four years experience practicing real estate. In Texas, a real estate broker must have a four year college degree or an equivalent number of college hours and pass a comprehensive real estate brokerage exam. Texas real estate brokers typically work as Realtors and can supervise teams of real estate agents working under them. All real estate agents must work for a real estate broker.

A REALTOR is a real estate agent or real estate broker who is a member of the National Association of Realtors. All Realtors are real estate agents or brokers, but not all real estate agents are Realtors. Realtors agree to abide by the National Association of Realtors Code of Ethics and Standards of Practice. Real estate agents must be a REALTOR to join a Multiple Listing Service commonly known as a MLS in order to market their listings to other Realtors and their real estate buyers.

A Multiple Listing Service, commonly referred to as a MLS, are used by real estate brokers to market their listings to other real estate brokers. A real estate broker who belongs to a MLS submits their listings to the MLS and offers a commission to any MLS member agent that submits an acceptable offer that results in a closed sale. Sellers benefit by having their home listing marketed by thousands of real estate agents. Buyers benefit by being able to have one buyer agent show them any home on the market. Real estate brokers and agents benefit by having a level playing field where the smallest brokerage can compete with the largest multi-state franchise.

A financing contingency allows a buyer to terminate the purchase contract and receive a refund of their earnest money if the buyer is unable to obtain mortgage financing within a defined period of time. The contingency period is negotiated between the buyer and seller and usually lasts between 7 and 21 days. The buyer does not have to be disapproved for the mortgage, they only have to believe they will not be approved. The buyer must give written notice to the seller that they are terminating the contract under the financing contingency during the negotiated period. A financing contingency protects a buyer from losing their earnest money if they cannot obtain a mortgage loan on their home purchase.

A MLS listing is a real estate listing that has been offered for sale or for rent on the MLS system by a real estate agent who is a member of a Multiple Listing Service. A real estate broker who belongs to a MLS submits their listings to the MLS and offers a commission to any MLS member agent that submits an acceptable offer that results in a closed sale.

Houston Prime Realty offers its real estate buyer agent services to real estate buyers for free. Houston Prime Realty is a member of the Houston MLS, the Bryan – College Station MLS, and the Brazoria County MLS and provides free buyer agent services to any real estate buyer of homes for sale or real estate for sale that is listed in any of these MLS systems. The real estate sellers of MLS listed properties agree to pay the commissions of real estate buyer agents. Find can find out more about how to buy Houston Real Estate on our Buyer page.

I have had several clients who have paid off their mortgage or paid cash for their home and did not carry homeowners insurance. This can be very risky. Just take a look at this photo, these Houston real estate owners let their insurance lapse and now their partially burned home is sitting vacant and has become a neighborhood eyesore.

Some investors prefer not to have the yearly cost of property insurance and will self insure. Some Houston real estate owners will fail to renew their policies due to the rising cost of property insurance. Cash buyers will want to save on upfront costs of buying a home and decide not to purchase property insurance. There are many reasons Houston real estate buyers can have for not having homeowners insurance. However, one look at the photo of this fire damaged home should make you think twice. You can find the names of several professional insurance agents in our Business Directory who can help homeowners find an affordable homeowners insurance policy.

One of the first steps in purchasing a home or real estate is to get a mortgage pre-approval letter from a bank, credit union or mortgage company. A mortgage pre-approval letter is customary when submitting an offer on real estate in Texas. Buyers can contact any mortgage lender and request a pre-approval letter. The lender will ask for income information for the applicant and will pull a consumer credit report on the applicant.

The pre-approval letter will state if the applicant is likely to be approved for a mortgage loan and the price of the home or real estate the borrower is qualified to purchase based on their credit and income. Mortgage pre-approvals are based on the applicants income credit at the time of application and can be revoked or modified if their income or credit changes prior to closing. Sellers of real estate expect a pre-approval letter to be submitted with all purchase offers and will generally not consider an offer without one.

Buyers can obtain a mortgage pre-approval letter from any mortgage lender they choose. Check out Mortgage Lender Directory for a list of lenders we have worked with.

A seller lease back is a contract provision that allows the seller to stay in their home for a period of time after the closing date of a home sale. The seller may be charged a daily rental rate or it may be at no charge to the seller, depending on the terms of the contract. The seller lease back provision in a real estate contract protects the seller from having to move out of their home prior to the closing and then finding out the buyer is unable to close on the sale. We recommend all home sellers ask for this in the contract negotiations. Without the seller lease back, the seller is expected to vacate the home prior to the closing.

A home seller may ask the real estate buyer to provide their Highest and Best offer when the seller has received multiple offers on the home for sale. By doing this, the seller does not have to pick one offer to accept or counter and gives all buyers an equal chance to make the highest bid on the property.

A financing contingency allows a buyer to terminate the purchase contract and receive a refund of their earnest money if the buyer is unable to obtain mortgage financing within a defined period of time. The contingency period is negotiated between the buyer and seller and usually lasts between 7 and 21 days. The buyer does not have to be disapproved for the mortgage, they only have to believe they will not be approved. The buyer must give written notice to the seller that they are terminating the contract under the financing contingency during the negotiated period. A financing contingency protects a buyer from losing their earnest money if they cannot obtain a mortgage loan on their home purchase.