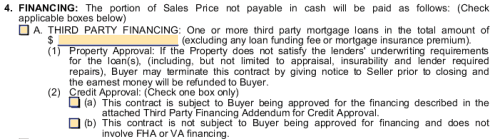

Credit Approval

A financing contingency allows a home buyer to terminate the purchase contract and receive a refund of their earnest money if the buyer is unable to obtain mortgage financing credit approval within a defined period of time. The contingency period is negotiated between the buyer and seller and usually lasts between 7 and 21 days.

Under the Credit Approval Clause, the home buyer does not have to be disapproved for the mortgage, they only have to believe they will not be approved. The buyer must give written notice to the seller that they are terminating the contract under the financing contingency during the negotiated period. A financing contingency protects a home buyer from losing their earnest money if they cannot obtain a mortgage loan on their home purchase.

Property Approval

Under the Property Approval Clause, the buyer can terminate the contract if the property does not meet the lender’s appraisal requirements, if the property cannot be insured, or if the property requires repairs that the seller is unwilling to perform or the lender is unwilling to accept. Most lenders require that the property have an appraised value of at least the sales price. These factors could cause the subject property to not meet the lenders underwriting requirements and would allow the buyer to terminate the contract at any time prior to closing.

For More Information or Ask a Question at our Houston Real Estate Buyer FAQ and our Houston Real Estate Seller FAQ

Leave a Reply